Helping clients make the most from their investment

Helping clients make the most from their investment

If your business owns its operating premises, has completed commercial fit-out works, or owns substantial plant and equipment, tax depreciation could be delivering thousands—or even hundreds of thousands—of dollars in annual tax savings. Yet business asset depreciation remains one of the most overlooked deductions available to Australian businesses.

At Costin Quantity Surveyors, we specialize in preparing comprehensive business property depreciation schedules that capture every legitimate deduction for commercial premises, fit-outs, equipment, and business assets throughout Melbourne and across Australia.

For many Melbourne businesses, depreciation represents one of the largest annual tax deductions available.

Unlike other business deductions that require ongoing spending, depreciation is a calculated deduction based on assets you’ve already purchased. There’s no annual expenditure needed to claim substantial tax savings year after year.

Business depreciation is available regardless of your operating structure:

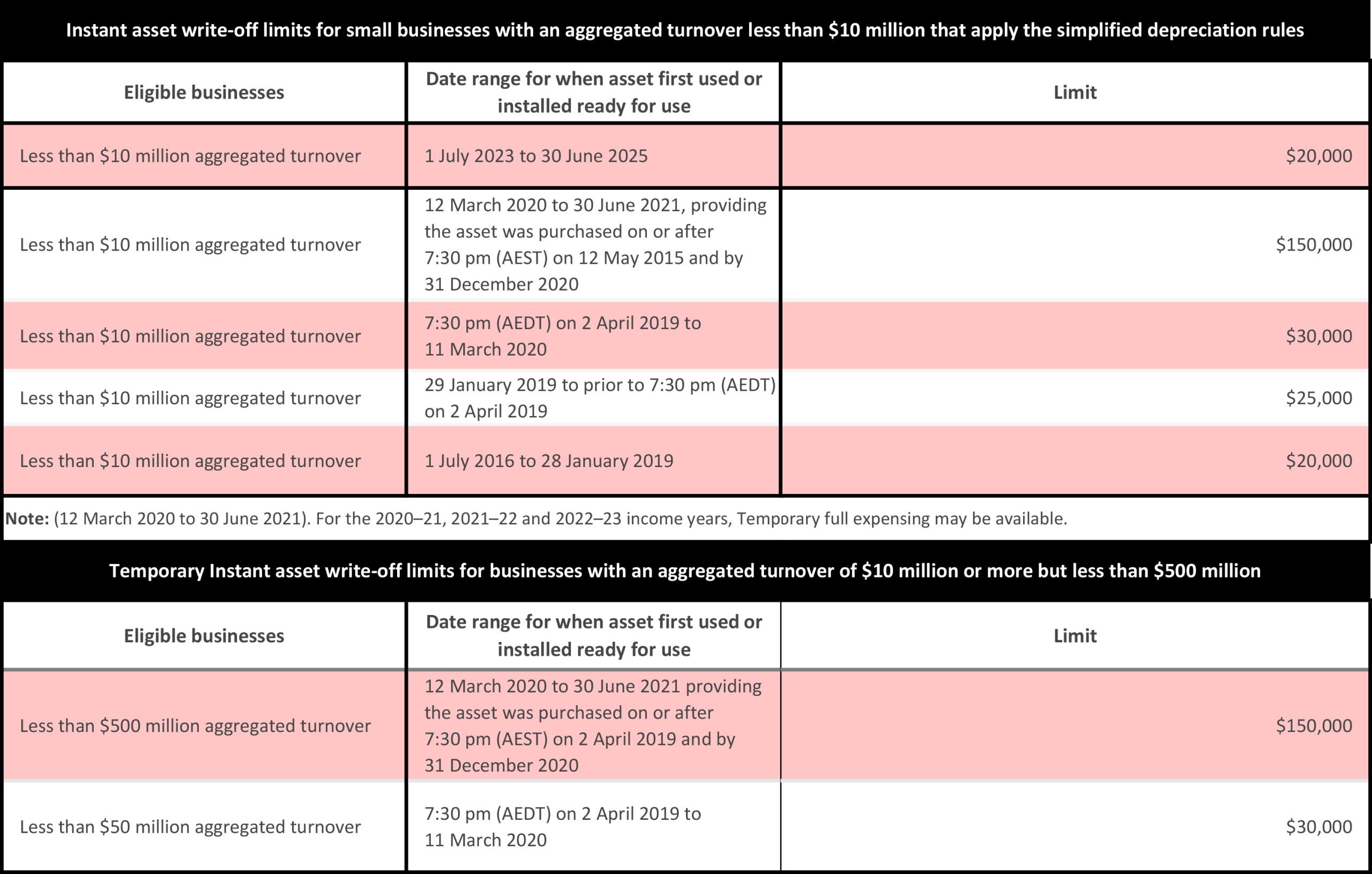

The limits have changed over recent years.

The instant asset write-off eligibility criteria and limit have changed over time. You need to check your business’s eligibility and apply the relevant limit amount. The income year in which you may claim an instant asset write-off depends on when the asset was purchased, first used or installed ready for use.

Eligibility

Eligibility, and the year in which you may use the instant asset write-off to claim an immediate deduction for an asset depends on:

Limit

This table shows instant asset write-off limit.

If your business owns the property it operates from, you can claim depreciation on:

These capital works depreciate at 2.5% annually (or 4% for some industrial buildings), providing consistent deductions for 40 years.

Rate -Capital works deductions for buildings and structural improvements (as ATO) – Learn More

If you're a tenant who has funded fit-out works:

Leasehold improvements depreciate over the shorter of the lease period or the works' effective life.

Rate -Capital works deductions for buildings and structural improvements (as ATO) – Learn More

Restaurants, cafes, pubs, hotels, and catering businesses benefit from:

Doctors, dentists, physiotherapists, and allied health professionals can claim:

Shops, boutiques, and retail operations depreciate:

Accounting, legal, consulting, and professional firms claim:

Manufacturers and industrial businesses access:

Mechanics, car washes, and service businesses depreciate:

These only few business types. Feel free contact us for more info

Discuss your business, premises, and equipment with our team. We’ll explain depreciation opportunities specific to your industry and business structure.

We’ll request:

Our quantity surveyors identify all your property tax depreciation deductions:

This business-focused knowledge ensures schedules that maximize legitimate deductions while maintaining complete defensibility.

Yes! Commercial tenants can claim depreciation on:

You cannot claim building structure or landlord-owned improvements.

When purchasing an existing business, you can claim depreciation on:

Asset values are typically allocated from the total purchase price, and our schedules document this allocation professionally.

Depreciation claimed during ownership may be included in capital gains calculations when selling. However, the annual tax savings throughout ownership typically far exceed any CGT impact. Your accountant can advise on sale structures to optimize outcomes.

Ideal documentation includes:

However, even without complete records, our quantity surveyors can professionally estimate values for depreciation purposes—this is specifically recognized by the ATO.

Don’t miss out on thousands in legitimate business tax deductions. A professional business property depreciation schedule from Costin Quantity Surveyors ensures you claim every available dollar while maintaining complete ATO compliance.

Contact our Melbourne business depreciation specialists today for a free, no-obligation assessment of your depreciation opportunities.

Have you ordered a depreciation schedule for your commercial property. We are available 24 hours a day / 7 days a week and Australia wide.

Helping investors to claim maximum depreciation deduction. We will find the best way to save you dollars specific to your individual property or investment needs.