Helping clients make the most from their investment

Helping clients make the most from their investment

The capital works deduction is available for:

The land itself can’t be written off and its cost isn’t deductible.

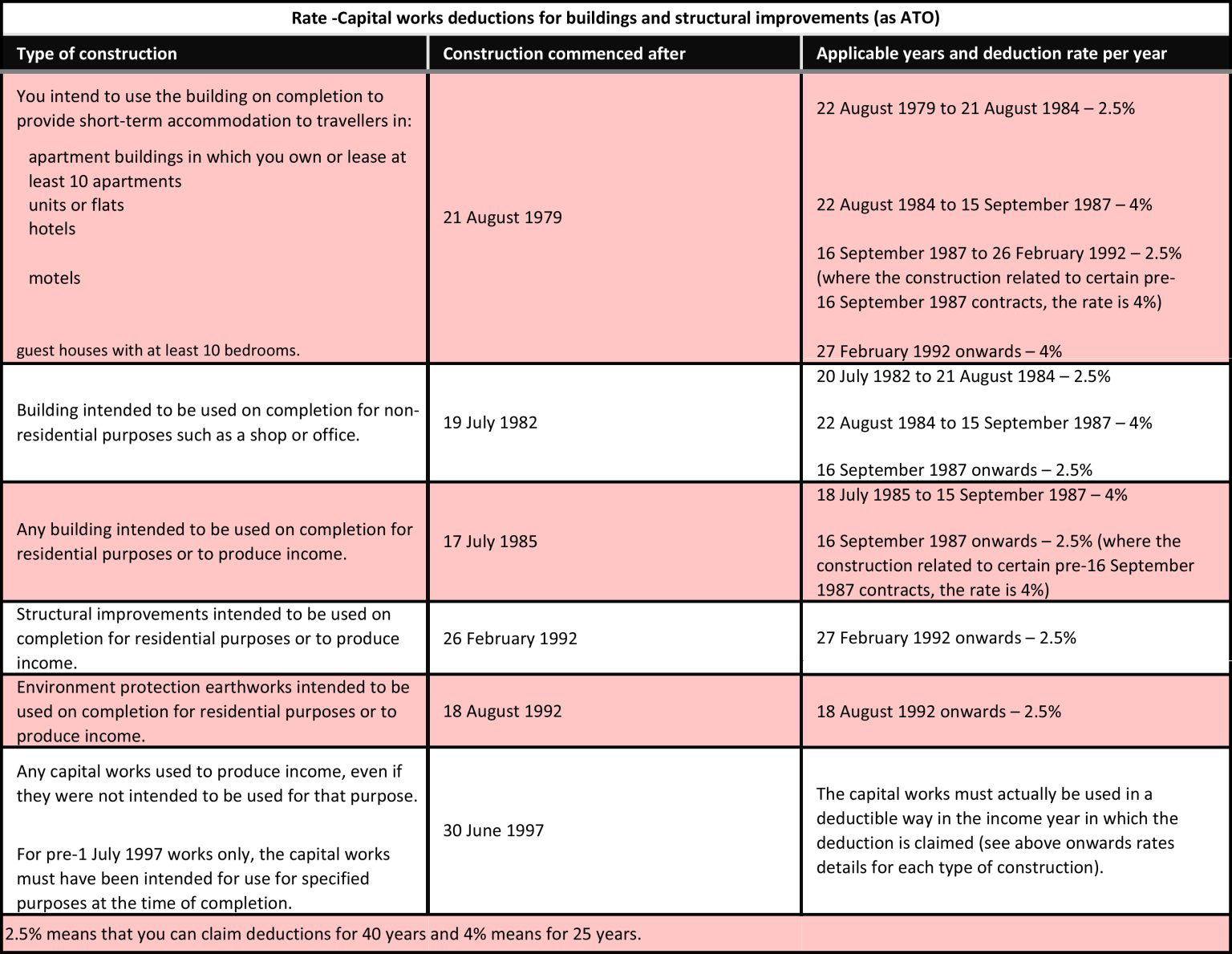

The amount you can claim for construction expenses depends on the type of construction and the date you start construction. Your capital works deductions can’t exceed the construction expenses. This table shows the rate of deduction and the period over which you can claim the deduction depending on the type of construction.